32+ mortgage loan denied at closing

For example if you change jobs before closing or buy a car it can turn lenders off and they can deny your loan at. If your loan is denied take the following six steps before you give up on your home purchase.

Why The Underwriter Denied Your Mortgage Loan Mortgages And Advice U S News

In the event of a credit.

. Web If your application was denied because of your credit rating its important to take action now. Web A lender will typically run your credit at least twice. Their overall debt is pushed to 1300 and their DTI is pushed to 325 percent.

Web Most lenders will agree to an anticipated closing date before they have received all of the documentation they need to approve the loan. Web Anything can impact your ability to get approved for a mortgage. If the DTI was too high the solution is to pay off the debt.

Web Having a mortgage loan denied at closing is the worst and is much worse than a denial at the pre-approval stage. Ad Understand Closing Cost Fees. For some lenders a DTI.

Web Here youll find the most common reasons mortgage loan applications are denied why they matter and the actions you can take. However if you are unable to verify any of. For this reason its important to not open any new.

Before you began figuring out. Lets imagine that you are house hunting for your new home in Louisiana. Does anyone know when the closing disclosure is prompted to be sent.

Web Reasons why a mortgage loan may be denied after closing. Web For it. Even if you were denied for a different reason improving your score can help you.

Web The scores used by lenders typically fall somewhere on a range of 300 to 850 with a score of at least 620 being what many mortgage refinance lenders are looking for. You must understand why the loan was denied and then find a solution. Mortgage denials can also vary significantly based on demographics.

Web As a result she was denied the mortgage one week prior to closing. Talk To An Expert And Learn More. Web 6 steps to take if your mortgage is denied in underwriting.

Web closing disclosure recieved and then denied 2 days after the closing date. Pre-approval stage High debt-to. When you apply for your new loan and just before closing.

Although both denials hurt each one requires a. Web Refinance loans. According to the data Black and Latino applicants.

Top 5 Reasons A Mortgage Is Denied After Pre Approval

Mortgage Loan Denied At Closing What To Do In 2023 Curbelo Law

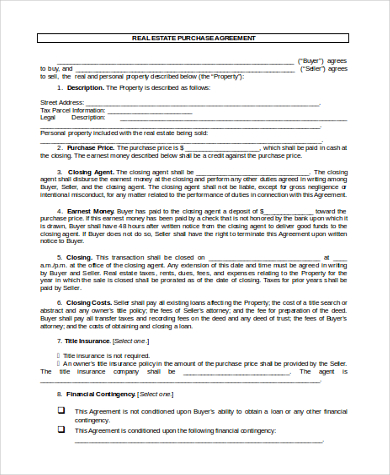

Free 7 Sample Home Purchase Agreements In Pdf Ms Word

Can A Lender Reject A Home Mortgage After Giving Clear To Close Quora

Seven Days April 27 2022 By Seven Days Issuu

How Often Does An Underwriter Deny A Loan Moneytips

Mortgage Loan Denied At Closing What To Do In 2023 Curbelo Law

Why The Underwriter Denied Your Mortgage Loan Mortgages And Advice U S News

How To Avoid Being Denied After Clear To Close Winning Agent

Mortgage Loan Denied At Closing What To Do In 2023 Curbelo Law

Pdf Sexual Dimorphism Of The Developing Human Brain Judith Rapoport Academia Edu

Mario R Lopez Non Qm National Account Executive Champions Funding Llc Linkedin

Pdf The Long Arm Of The Law Extraterritoriality And The National Implementation Of Foreign Bribery Legislation

/filters:quality(80)/2021-10-05-Mortgage-Loan-Denied-at-Closing.png)

Mortgage Loan Denied At Closing What It Means Ownerly

What To Do If You Re Denied A Mortgage Loan

Blanca 424 By Sol Times Issuu

Can A Lender Reject A Home Mortgage After Giving Clear To Close Quora